Read in Ukrainian

On July 4, at the Energy Club Reception, experts discussed "Beyond Synchronization: The Possibilities and Challenges for Commercial Electricity Exports from Ukraine to its EU Neighbors".

During the discussion, the experts tried to answer the following questions:

- What are the technical requirements by ENTSO-E to be implemented before electricity exports from Ukraine to its EU neighbors are possible? What is the implementation timeline and how can it be shortened?

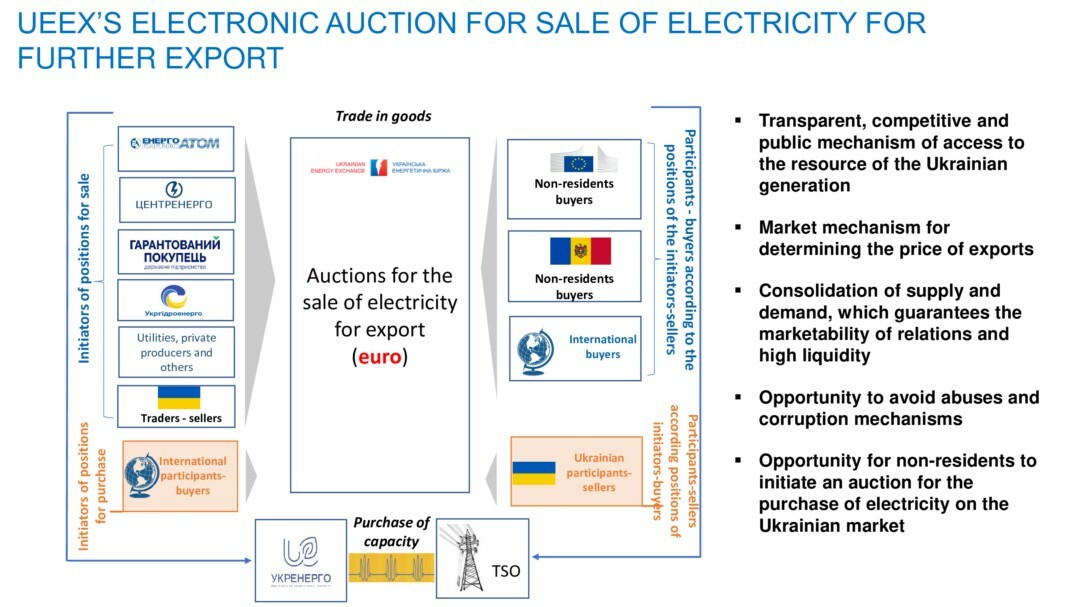

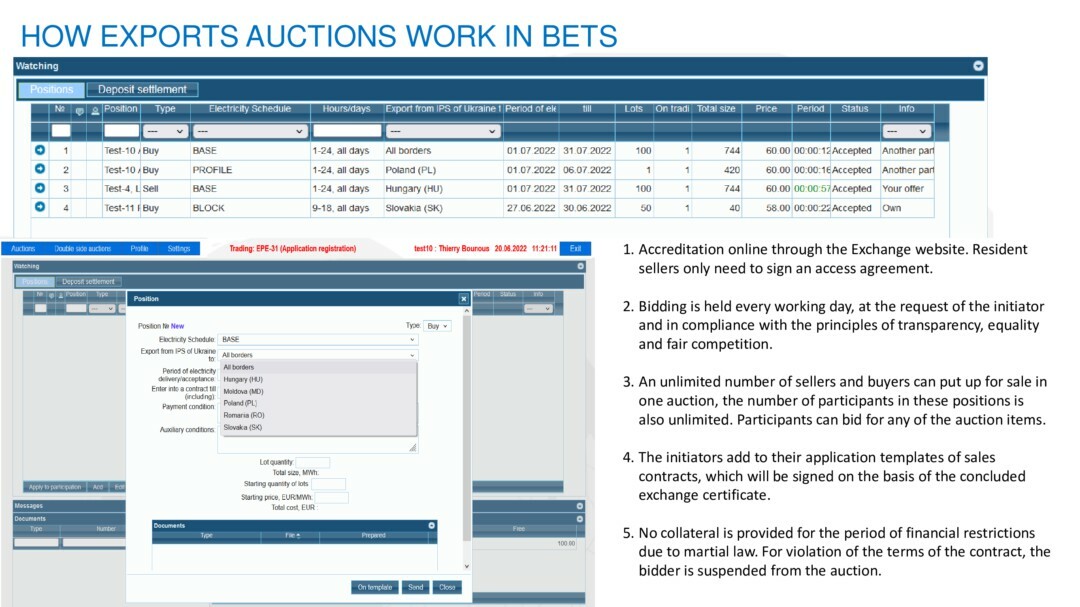

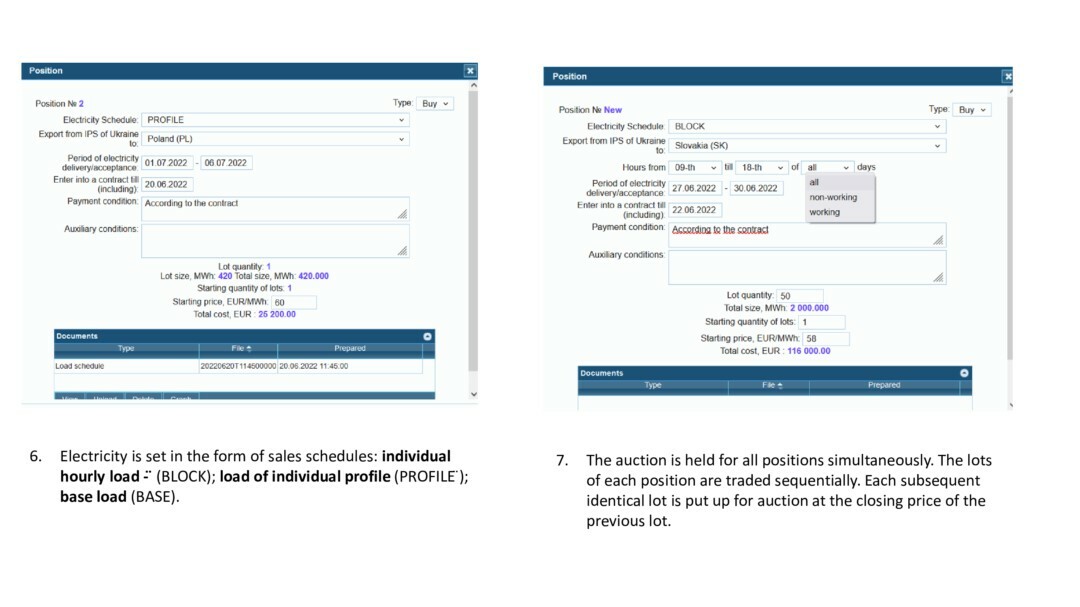

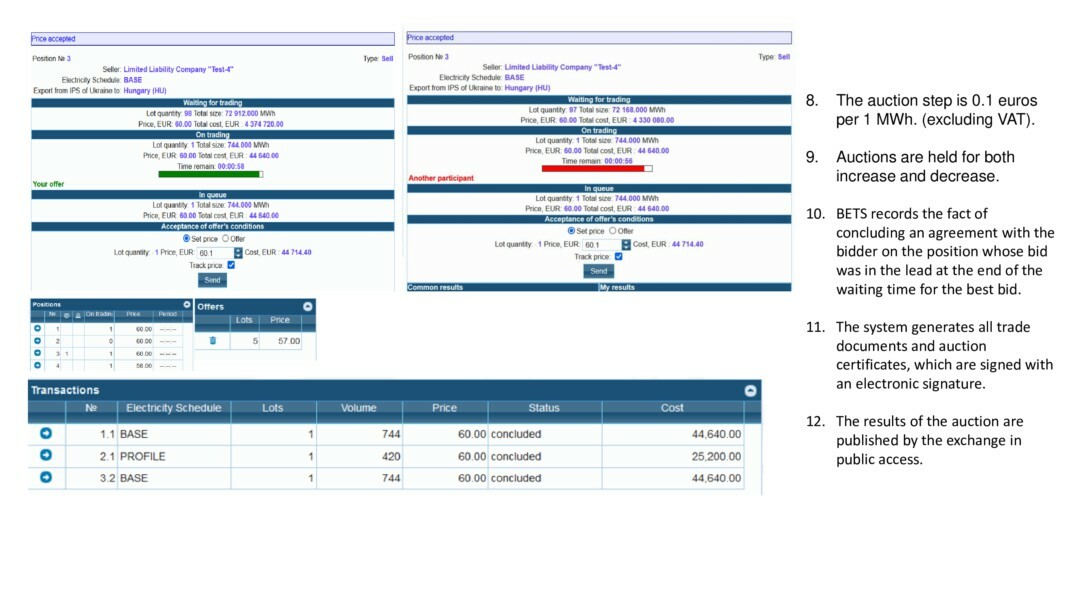

- What would be the ideal model for such electricity exports? What would be the role of the Ukrainian Energy Exchange?

- What possibilities do traders see for electricity exports from Ukraine? What potential stumbling blocks do they see for such trade to be made possible?

Key messages of the speakers' speeches

Albino Marques, Coordinator for the Continental Europe Region, ENTSO-E

Whether commercial exchange is possible and how much could be supplied?

1. Commercial cross—border exchange is possible under six preconditions (see presentation) to ensure dynamic system stability, interconnected system security and data exchange with TSO and RSC; coordinated process integration.

2. From 7th June we witnessed gradual increase of the commercial exchanges between Ukraine and its neighbours.

3. Unless capacity calculation procedure is in full action, we cannot predict how much electricity could be transferred from Ukraine to Europe.

What impact Ukraine may have on the energy supplies to Europe?

1. EU Commission is fully supportive of the Ukraine’s commercial exchange. 210 MW were supplied in late March, and this is beneficial for both sides:

- Provide cheap energy to the Eu to decrease high prices

- To resolve the liquidity issue in Ukraine

3. We need to strengthen infrastructure. During reconstruction of Ukraine, we need to strengthen the lines which might be the priorities for rebuilding. It might be relevant to have a list of such priorities for construction and reconstruction.

4. Ukraine has big potential for renewables.

5. In the context of the hard winter ahead we must show solidarity and allow capacity exchange increase as much as possible.

6. In terms of volumes, we push for more than 400 MW per month. We should go as far as possible with maximum amounts, of course complying with technical conditions and constraints. In this context renovation of lines connecting Ukraine with Poland and Moldova are very important.

7. Ukraine’s electricity sector needs a lot of reform that is why High-Level Working Group between Ukraine and EU on synchronization will be relaunched in September to plan those reforms needed for electricity market to be coupled the EU market. Harmonization of the rules in terms of transparency, operation and of market.

8. We may expect to see a full shutdown of gas supplies soon that’s why we have to electrify those industries which use gas. This will be in line with the Green Deal and decarbonizing our economy, increase local production of renewables, shifting from gas to electricity.

What problems are in Ukraine electricity market that can have negative impact on future increase in cross-border electricity exchange?

1. Key consideration for the exchange is: to optimize the resources and to optimize the use of capacity.

2. Even under war conditions the market model should be kept as it is to the extent that is possible because this will give the right signal whether there should be import or export of electricity. From technical point of view there is a team of ENTSO-E experts working with Ukrenergo and identifying the right amounts that could be traded technically. This is not capacity and capacity calculation by itself, we are talking about relatively small figures now. But at some point, this will be given to the hands of the TSO and technical codes of the Energy Community will be applied. The sector has to be prepared to that.

3. How the capacity made available by the TSOs is made available in the market? What kind of products do you have for allocation? - 100 MW for cross border exchange plus what will go through Poland and unilateral auction - all that are not the ideal measures.

4. This brings in the question: what market mechanism should be used to allocate this capacity? - Joint allocation process that is what we aim for the coordinated capacity allocation. In midterm, in a month, we should see some border-joint capacity allocation and not only for the day-ahead products, but weekly and monthly capacity products. And the ability of market participants to hedge their production or consumption.

5. Financial settlement for deviation that started from 1st June is one of the first financial integration pan-European mechanisms that was integrated by Ukrenergo. Further on we will see the ATC-mechanism for inter-TSO transits and so on. Those will be the basis on which other market elements will be then developed.

What will be the impact of Ukraine’s imported electricity on European electricity process when there is not 100 MW but thousands of MW?

1. Today trader companies fear this market because of the war and operational difficulties to deal with a country where the is martial law in force; the war also brings about high tense risk of the disruptions.

2. Current export capacity is not enough and to increase it even to 150 MW we will need to find a sort of monthly allocation mechanism to enable more power to be exported.

3. On Ukraine’s side there is a need for transition dispatch goal to incentivize the companies. We also need ForEx regulation to simplify access to currencies. There are other non-energy issues that influence the cross-border flows: VAT, for example. There is a cocktail of measures that could be taken up to incentivize the electricity trade inside Ukraine and outside.

4. Inside Ukraine:

- Lack of liquidity before the war

- Not enough incentives for nuclear generation to go into the market

- You need to look better what could be done to incentivize domestic trade instead of going to the external market.

Fatih Kolmek, Senior Electricity Manager, USAID Energy Security Project

Do we have huge obstacles to paving the way for electricity trade between Ukraine and other countries? Are you optimistic or pessimistic on that?

I’m optimistic because:

1. Synchronization was done successfully; a lot of homework was done by Ukraine and that made that huge solidarity step possible.

2. We were planning joint allocations to start next year, but Ukraine is already one year ahead of its schedule.

3. ESP: we have started together with stakeholders to do what is needed.

4. Significant obstacles:

- Further synchronization will require a lot

- Trading needs standardization. Trading products and risk mitigation should be aligned with what is in place in Europe

- Market monitoring: over-concentration and low liquidity might be impediments. ENTSO-E synchronization and EU candidate status might be turned into something very practical.

Are you optimistic or pessimistic as to the auctions?

I’m more optimistic. 100 MW is a starting point.

1. In the past 97% of exported energy was coming from Burshtyn Island and was from 1 power plant and 1 company. Now the share of that company is 25% in a small 100 MW corridor. That is, competition works.

2. Auctions. Future depends on the observations of our engineers how that first 100 MW will technically suit our grids. Based on that conclusion monthly auctions will be developed.

3. Now we have 13 companies actively participating in the daily auctions although we have 200 companies registered for the auctions -this is potential for the growing participation in auctions.

What do you think about potential investors? Will be investments possible? What could be done to incentivize the process?

1. Reconstruction will be required after the war.

2. Due to synchronization and for cross-border exchange new interconnectors will be needed. This may require up to 130 billion Euros, partially in EU grants, EBRD loans; partially this may come from private investors.

3. Major requirements for investments and cross-border trading: favorable conditions for market operation. That is, transparency regulations, new energy codes, transmission rights, market coupling – all that is reducing risks for investors.

4. A key factor will be a level of reform in the sector able to improve investment climate:

- To resolve the issues with renewables and payments for RE

- To resolve the issue with corporate governance

- Further synchronization, that will create opportunities for further investments and not just from private sector.

1. We are positively surprised with first commercial exchanges last month.

2. Price difference in Ukraine and Hungary creates incentives for the trade. But we do not wish to have a situation when Ukraine is subsidizing the Europeans because of price caps in Ukraine and absence of price caps in Europe.

3. ETC on the border is the biggest technical issue now.

4. Ensuring transparency in the sector is the must.

5. Think about proper energy mix in clean energy: nuke and hydro.

What are your estimates as to the trade in next months and in winter which promises to be hard?

1. We have reserve capacity of about 2500 MW for sale. But transmission capacity is limited, and cross-border exchange is limited to 100 MW.

2. We are very much interested in the increase of our export capacity. Reconstruction of our war-damaged facilities will require a lot of money and increasing export would open for us access to cheaper short-term loans.

3. June 20, 2022, Energoatom has started export to Moldova, sales are estimated to be at the level of 75,000 MWh. Upgrading of overhead transmission line Khmelnitsky NPP-Rzhechuv up to 420KV would also increase our technical capacities.

4. We remain one of the main providers of PSO, and quite reliable one.

5. As of now our share in the cross-border exchange is 15-25 MW out of 100 MW.

What can you say about the energy prices now and in winter?

1. The market is trying to find optimal price now. We need to collect more data about the actual market situation.

2. We have issues with solar futures and with monthly futures.

3. We have the issue with certification of renewables.

4. Price for allocation in Europe currently is Euro200/Euro 300 for 1 MW in Romania.

5. Trading in winter: the cross-border exchanges should grow because we have lost 30% of consumers in Ukraine.

What is now happening in the market? When will renewable producers start to export from Ukraine?

1. Under current horrible unfortunate conditions of war Ukraine is paving track much faster than it was supposed to do in evolutionary manner. The test for us now in this specific situation is how we perform as a partner for future extension, given the technical parameters ENTSO-E is coordinating for Ukrainian side.

2. The issue of export of Ukraine’s clean energy to the EU is very interesting. Absence of short, middle and long-term strategy is supplemented by the war right now. Having renewable generation we never had a plan and source of investments into balancing capacities. We had adequacy reports from TSO s but not a bridge to exports: how much we can export?

3. One of the corner stones for Ukraine to provide transparency and predictability to our EU partners is to develop a short-term strategy

- Who much and what generation will be available.

- How much of the demand we will have inside the country?

- Impact of war on the market is significant: minus 30%. This seems to have stabilized and much will depend on our military successes.

- Joint capacity allocation

- Implementation of remit transparency regulation bringing our market rules in line with the Eu

- To launch inter-transmission compensation mechanism, which is direct pricing impact to incentivize trading.

6. Price dynamics in the market vs public service obligation (CACM).

7. Strong and sustainable institutions as a key factor for predictability and transparency in the context of Ukraine’s government reform.

8. Price caps in the market are a source of price difference between markets. But security of supplies has the cost attached to it and we will have sooner or later to phase this cost to be sustainable.

Q&A:

Q: Ukraine lost about 10 GW of capacity as a result of Russian aggression. How will this affect export opportunities during the 2022-2023 heating season?A by Olena Antonova: Ukraine has lost both generation side and on demand side. And reconciliation figures will be prepared by TSO and submitted to the Ministry. It seems now that we are in surplus side in generation and potentially may export to the EU.

Q: Can we expect soon that other borders could be open for trading not just Romania?

A by Albino Marques: Auction with Slovakia will be opened following days, as well as common auction with Hungary and a short-term period.

Q: Increase of export from Ukraine will happen due to synchronization or due to drop in industrial demand?

A by Olena Antonova and Albino Marques:

- Synchronization had to be implemented anyway by 2023.

- Direct impact of the war was isolated mode to ensure security of supplies.

- Growing negative impact of the war and need to sustain Ukrainian economy.

- The way to minimize financial support to Ukraine is looking at commercializing.

Mykhailo Bno-Airiian, Deputy CEO for communications and international cooperation at NPC Ukrenergo (2016-2019)

- Ukraine is part of the EU electricity market, export and import is becoming possible.

- Additional liquidity is very beneficial for Ukraine electricity market.

- In today’s situation with gas synchronization and cross-border trade is very beneficial from the security of supplies point of view.