90 Days of Confrontation with Russian Aggression: Analysis and Forecast in the Context of Ukrainian Energy

Three months have passed since the full-scale invasion of Ukraine by Russian troops. Our state's heroic fight for independence is underway on all fronts, including the energy sector.

1. Coal and natural gas reserves

For all the brutality of the war unleashed by Russia, Ukraine has managed to double its coal reserves in storage to 1.35 million tons. This figure is unprecedented for three reasons. First, the main source of supply to the depots - own coal production has fallen by about 30 percent since the beginning of the war. Second, communication and control over the two state-owned mines was lost. Third, the logistical hubs for coal shipment have been and continue to be under constant bombardment.

Also noteworthy is the fact that since February 28, the season of pumping natural gas into individual storage facilities actually began. At the same time, the rate was 10 million cubic meters per day, which was four times higher than the daily withdrawal rate. Thus, as of March 21, there were 9.5 billion cubic meters of natural gas stored in the domestic gas storages, i.e. half of the volume which started the heating season.

Injection volumes began to exceed extraction as early as March 31, thereby transferring the domestic gas storage facilities into the mode of gradual filling with the blue fuel. As of May 15, according to UCfML's estimates, over 10.2 billion cubic meters have been stored in Ukrainian gas storages, which is a fairly optimistic level of reserves. It is worth recalling that Ukraine finished the 2014-2015 heating season with 7.6bn cu.m. of gas in storage.

At the same time, EU countries are demonstrating record rates of accumulation of natural gas in storage facilities. As of May 20, European storage facilities are 41 percent full, which is 7 percent more than at the same date last year. Poland and Portugal are the most active in filling their reserves.

2. The gas market

Due to the Russian invasion and widespread destruction, there was a 32% drop in natural gas consumption compared to the same periods last year[1]. At the same time, the volume of natural gas production in Ukraine, since the beginning of the war, has decreased by 12% and dropped to 48.8 million cubic meters per day [2]. Such volumes of gas in the summer season are sufficient for an insignificant build-up of reserves in storage facilities and to fully cover the needs of domestic consumers. Therefore, the plan for accumulation of gas in storage will be carried out mainly with imported resources. At the same time, it should be noted that the daily supplies of gas from the EU to Ukraine currently remain at a minimum level of 113,000 cu.m., which is half as much as the average import mode in April.

The lack of a proper level of import supplies is obviously due to the low financial liquidity of the natural gas market. The deficit of funds for the purchase of gas is tentatively estimated at $5 billion, which can be covered by financial assistance from the EU and international financial institutions. Since the beginning of Russia's armed aggression, the largest volumes of imports from the EU were in March. At that time, the daily intake was 8.9 million cu.m., with 2/3 of this volume imported physically - the rest due to the virtual reverse. By the way, in the pre-war period, the import supply regime was at the level of 20 million cu.m./day[4]. It is also important to note that gas exports from Ukraine to the EU stopped on March 03, with the last transaction amounting to 6.4 million cubic meters per day.

Ukraine continues to meet the demands of European importers of Russian gas on time and in full.

During February, the transit regime was established in accordance with Gazprom's requests and performed a balancing role for the EU market. That is why there were quite insignificant changes in the daily volumes of transportation: from 75 mln cu.m. to 49 mln cu.m. and back again to 80 mln cu.m. However, starting from March and till the first decade of April, the transit mode was stable and was in the corridor of 95...109 million cubic meters a day. After April 12, according to Gazprom's requests, Ukraine's gas transportation system switched to minimum load modes. At that, the historical minimum volume of transit of Russian gas was fixed on April 15 at 38.4 million cubic meters, which is three times less than the average daily mode of March. Later on, in early May there was a short-term stabilization of the transit regime in the corridor of 89...99 mln cubic meters. However, after the capture of Novopskov compressor station[5] by the Russian troops, the daily volumes of gas transported to the EU fell back to 57 mln cubic meters.

Due to the war, exchange trading is very limited and the Ukrainian gas market is actually separated from European trading platforms due to abnormally low demand.

This is clearly seen in March, when a sharp increase in natural gas prices in Europe had almost no effect on the price situation in Ukraine. In fact, this led to extremely low volumes of gas supplies from the EU to the domestic market. Thus, from March to May, the average monthly price of natural gas on the Ukrainian wholesale market decreased by only 15% to the level of 31048 hryvnias per thousand cubic meters. The loss of synchronism between the Ukrainian and European gas markets has led to the fact that prices in our state, despite the fall in quotations in the EU, continue to remain at the same level.

At the same time, starting from May 25 the price of gas on the Ukrainian wholesale market will go down because of the opening of trading in June.

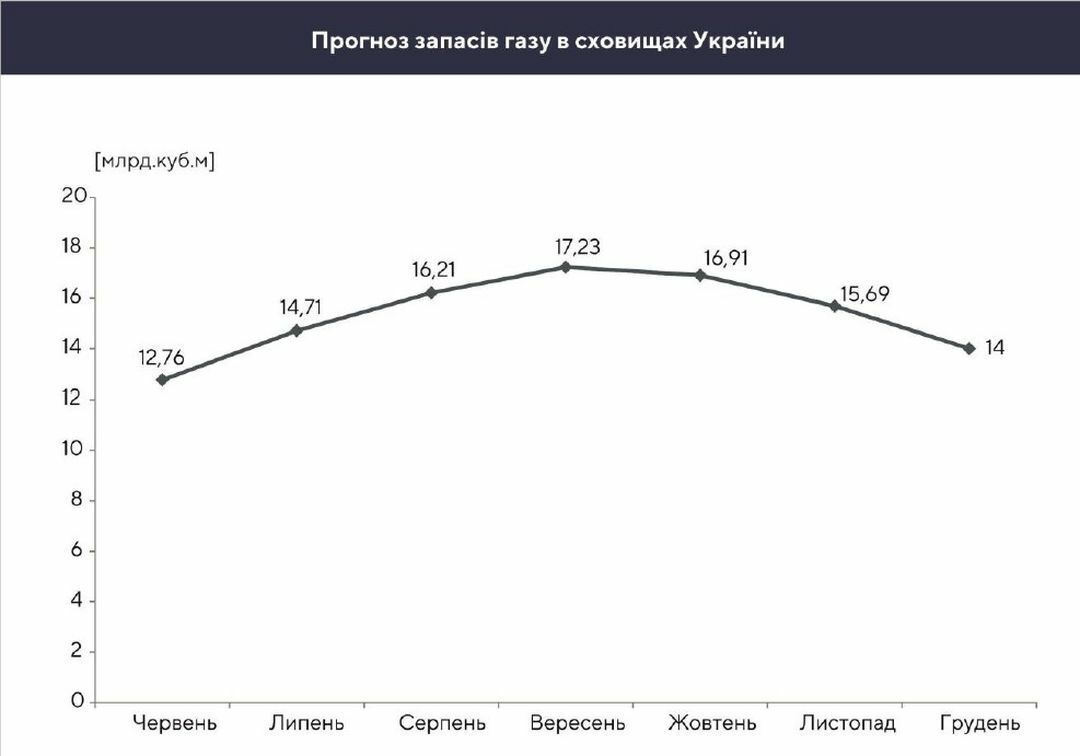

Based on the current disposition of the enemy's military forces and accordingly available resources and infrastructure for the domestic energy sector mathematical modeling of the scenario of preparation and passage of the heating season in the second half of 2022 has been conducted.

The total demand for natural gas for the period in question will be approximately 14 billion cubic meters, which will be covered by domestic production and imports respectively 70% and 30%. Given the current reserves and the need to meet consumer demand in the first quarter of 2023, our state needs to buy 7.7 billion cubic meters of natural gas in the European market.

At the same time, given the current price situation on the EU market, it is proposed that the largest share of imported gas (5.6bn cu.m.) be pumped during June-August. In general, we will need more than $8bn for gas purchases from the EU.

Thus, by the beginning of the heating season 2022, there will be 17.2 billion cubic meters of gas accumulated in the Ukrainian gas storages, which is 7% less than the previous year. Taking into account the current demand for natural gas in April 2023, 9.3 billion cubic meters of blue fuel will remain in storages.

3. Electricity market

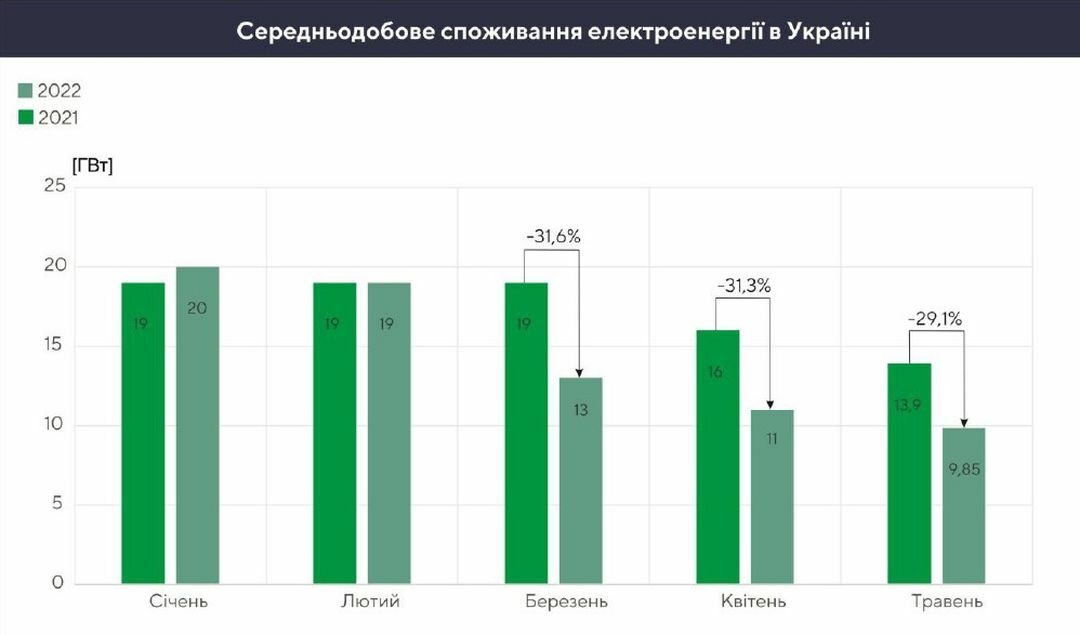

As a result of the Russian aggression, there was a sharp drop in electricity consumption, by 30.7% on average, compared to the same periods of the previous year. Thus, daily demand of 10 GW is covered by 6 GW by nuclear power plants, 2.1 GW by thermal power generation, 1.3 GW by hydropower plants and 0.6 GW by renewable energy sources.

At the same time, the level of payments for consumed electricity does not exceed 50%. This can be explained by the fact that about 3.5 million citizens were forced to leave Ukraine and up to 7 million more people became internally displaced and largely lost their ability to pay. Also, the majority of citizens who have remained in their places of residence have lost their incomes due to the shutdown of production facilities and also have difficulty paying.

These factors create a projected monthly shortfall of up to $0.5 billion for generating companies, which makes it extremely difficult to fund measures to repair and restore infrastructure, including in preparation for the next heating season. The most affected type of generation is thermal power plants, which can partially overcome the consequences of underfunding due to electricity exports to EU countries, where the price of electricity is at least double the market indicators of Ukraine.

The base load price index in the combined Ukrainian power system during February-May was actually in the same corridor and, despite synchronization with ENTSO-E[7], was significantly lower than the EU electricity price.

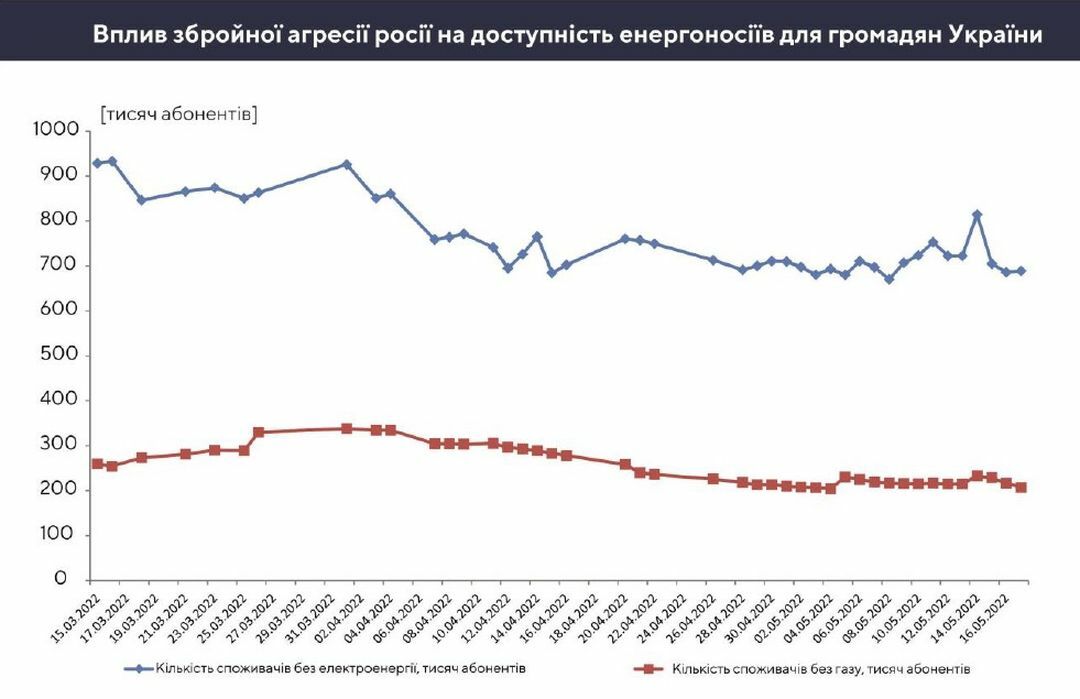

Compared to early April, as of May 20, electricity trade is picking up due to increased demand. For example, the base load index in the market segment of bilateral contracts over the last month cut by 5% to UAH 1789/MWh. A similar trend is observed in the day-ahead market segment, where demand has increased by 20% to 22.8 thou MWh since the beginning of May. At that, the average weighted price for the first ten days of May made 2287.60 UAH/MWh, which is only 1.8% less than in April. At the same time, the Ukrainian indicators are on average 47% lower than the prices in the neighboring European countries. The highest demand in the intraday market segment is 40 thou MWh, in particular, it falls on the peak load hours. Actually, this influenced the price growth, in comparison with April it increased by 7.6% up to 2,757 UAH/MWh. In general, the trend of demand growth in the intraday market segment and the maximum load hour shows a gradual resumption of industrial enterprises and commercial establishments. At the same time, due to Russia's armed aggression, as of May 20, more than 700 thousand subscribers (including commercial consumers) have no access to electricity supply.

At the same time, current balance sheet calculations indicate pricing trends, namely a gradual increase in wholesale electricity and gas prices. Thus, in the third quarter the wholesale price of gas will rise by about 30% and electricity by 15%.

Tentative schedules for covering the average daily demand on the Ukrainian electricity market have also been calculated. The calculations indicate the possibility of minimal involvement of thermal generation (from 1.1 to 1.9 GW) in summer period, which will allow to prepare coal-fired units for more intensive work in November and December (6.1 GW). The simulation results also indicate that the total coal demand for the second half of 2022 will be 5.3 million tons excluding stockpiles (1.8 million tons). Considering the current generation potential[8], there will be a need for power imports from the EU in December.

The projected balances of the gas and electricity markets will be refined in subsequent studies, taking into account migration changes and the situation on the front.

4. Oil products market

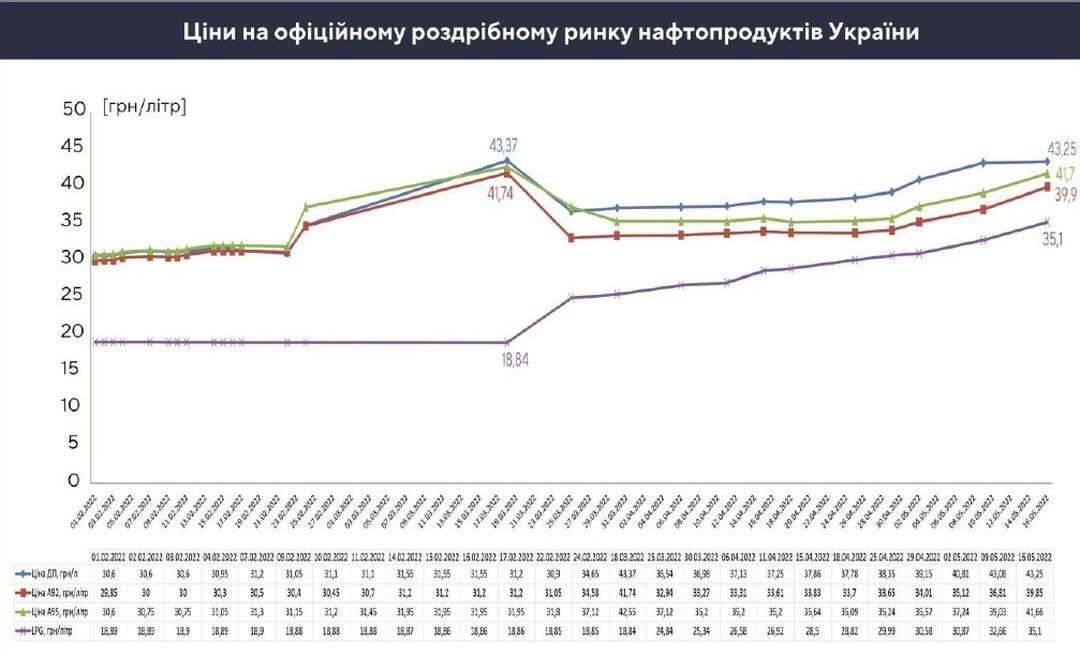

As a result of intensive rocket attacks of the Russian army, the oil and oil products storage infrastructure was significantly destroyed (more than 20% of bases were destroyed) and Kremenchug Refinery and Shebelyn GPP were forced to stop their work.

During March, there was a so-called controlled deficit of fuel in the retail segment of the market due to sufficient stocks of oil products earlier imported or produced at domestic refineries. At the same time, starting from April, after the start of the sowing campaign, the demand increased considerably and a period of acute shortage of fuel began. However, the price of petroleum products is significantly affected by the state regulation, which has actually divided the market into official and shadow ones.

The first group of gas stations sold the minimum amount of fuel in order to minimize the loss, because diesel fuel in the wholesale segment cost 44 UAH / l, while the price recommended by the state was only 37.42 UAH / l (at the beginning of April). Other sellers sold petroleum products on the principle of import parity, effectively forming a shadow segment of the retail market. In addition, the volume of shipments of low-quality motor fuel, which was produced at non-certified mini-refineries, increased.

Additional pressure led to problems associated with the restructuring of the prewar logistics model to the new one, where the vast majority of supplies are provided by tank trucks. Thus, oil products from Germany, Belgium and the Netherlands have been gradually entering the Ukrainian market since early May.

After the deregulation, the situation will gradually level off, but prices for petroleum products will rise at the same time. One should expect the price for gasoline A-95 to be 58 hryvnias/liter and diesel fuel 60 hryvnias/liter by the beginning of June. However, due to the cancellation of duties on imported cars from the EU, the expected demand for petroleum products increased by 8% to 450 thousand tons per month.

The further situation with stocks of oil products on the Ukrainian market will be positively affected by an increase in the share of rail shipments of fuel, the deployment of the Samara-Western direction product pipeline9 in reverse mode, as well as the transfer of the Glusco petrol stations network to the corporate management structure of Naftogaz of Ukraine. It is quite expected that the national company will use the underground tanks of each petrol station as a kind of a network of small storage facilities for petroleum products.

5. Global markets

In February and May, China saw a significant reduction in oil demand (down to 1.5 million barrels per day), which freed up 1.5 million barrels to cover demand in the EU. Thus, it was possible to avoid sharp jumps in WTI and Brent quotations against the background of the embargo on Russian oil.

At the same time, during March-April supplies of Russian oil and coal to the EU decreased by 20% and 40% respectively, but supplies of natural gas via pipelines and LNG-terminals increased by 10% and 20% respectively. If we recalculate in monetary terms, the final losses of the aggressor from the restrictions imposed during these two months do not exceed $12 billion, which is a paltry payment on their part for the entire scale of destruction and atrocity in Ukraine. It should be noted that a quarter of fossil fuels of Russian origin enter the EU by sea, with 75% of the cargoes being distributed among unremarkable ports and terminals for subsequent shipment of these resources for such well-known companies as Exxon Mobil, Shell, Total, Repsol, BP, Neste , Orlen.

Despite this since the beginning of a full-scale invasion of Ukraine by the aggressor state, the reference price of coal API-2 has increased by 68% to $321 per ton. The price of coal continues to remain in the corridor to $300, despite sufficient coal reserves in European warehouses (ARA) - 5.5 million tons, which is a record since December 2020.